Latino and Black poverty rates in Colorado are near historic lows, but economic stability is elusive

The kitchen table, round and glass, with wooden legs, sits in a sunlit corner of Alejandra Carrera and Clemente Flores’ apartment. It is one of the first things visitors see.

To the outsider, it’s a nice table. To the couple, married 26 years, it’s a symbol of their economic progress over the last decade. They bought it new, on sale, last year. “We have always had to buy second-hand,” Flores said. Puro segundo.

Their Aurora apartment is a newer one-bedroom, small like the others before it. But it is a big improvement from the roach-plagued aging buildings they could afford when they moved to Colorado 13 years ago.

Carrera, 66, and Flores, 67, call their home their “refuge,” the result of hard work, steady jobs and slowly rising incomes.

“Here, where we live now, we can rest when we don’t work and we feel comfortable,” Carrera said.

This is as close to the American Dream as they have ever been, she said.

The couple’s experience mirrors a larger trend of falling poverty rates among Black and Latino Coloradans — as well as their continued struggle toward economic prosperity.

A Colorado News Collaborative/Denver Post analysis of the most recent and historic Census data finds:

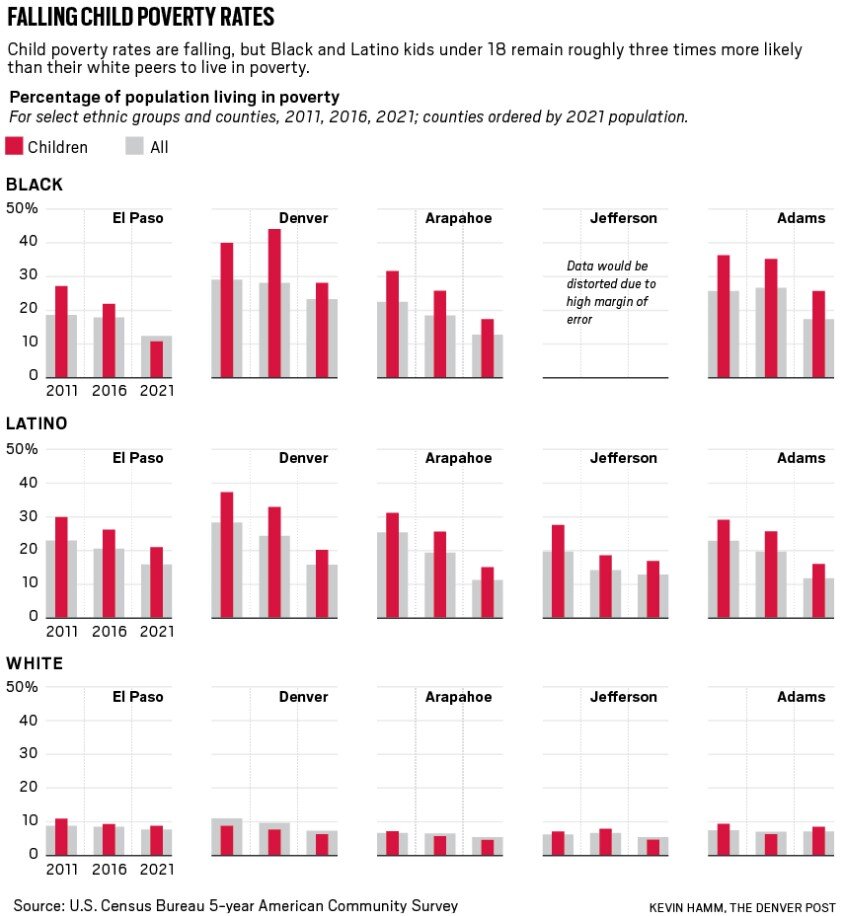

- Poverty rates for Latino Coloradans have been falling to near-historic lows. The trend, with occasional interruption by economic downturns, continues a more than half-century decline. The pandemic slightly reversed the course, but 2021’s 15% Latino poverty rate was still among the lowest recorded.

- The Latino-white poverty gap roughly halved between 2011 and 2021. Only Maine and Iowa, with relatively small Latino populations, saw a greater narrowing of that gap.

- Poverty rates for Black Coloradans have generally followed the same trend with nearly one in five living below poverty thresholds in 2021. The Black-white poverty gap narrowed more than in all but seven other states.

- White Coloradans’ poverty rates, which have hovered in the high single-digits for decades, fell between 2011 and 2021 to 7%.

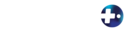

- Black and Latino children under 18 saw the steepest drops in poverty over the same period, a reflection in part of rising median household incomes and in line with other measurements recording historic declines among children nationwide over the last 25 years.

- Despite the falling poverty rates, Latino and Black Coloradans were still about twice as likely to live in poverty as white Coloradans. Black and Latino children were about three times as likely to live in poverty as their white peers.

Reliable data is unavailable for the state’s smaller Asian and Indigenous populations. The Denver Post and COLab examined poverty and other economic data between 2011 and 2021, the most recent Census data available, for Chasing Progress, a series on socio-economic and health equity gaps among Black, Latino and white Coloradans.

The drop in Black and Latino poverty rates is, on its face, encouraging, said Charles Brennan, deputy director of research at the Colorado Center on Law and Policy.

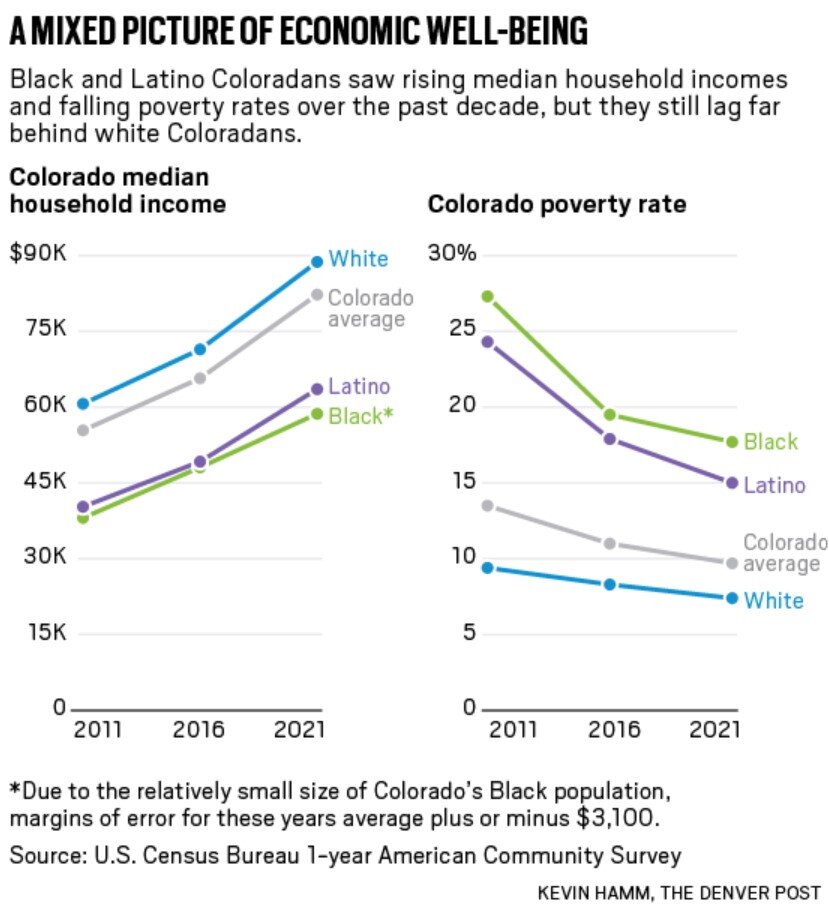

But he, like economists, community organizers, policymakers, advocates for children, low-wage workers and others, interviewed for this story cautioned that the official poverty threshold is only one measure of economic health. It is based on pre-tax cash income and three times the minimum cost of food in 1963, adjusted for today’s prices.

The more polite critics called the measure “antiquated.”

But the poverty threshold is the basis for government guidelines that help determine access to public assistance, such as food stamps. In 2021, the poverty guideline, adjusted for inflation and identical nationwide, was $26,500 for a family of four.

A real economic struggle exists in the space between official poverty and self-sufficiency, Alex Sánchez, president and CEO of Voces Unidas de las Montañas, said. Voces Unidas serves Latino residents in Colorado’s central mountain region, including Vail and Aspen, where many work in the construction, retail and service industries.

Families might be making more than $50,000 a year, he said, but “they are not making enough to make ends meet, much less to thrive. If we are using the same standard to measure poverty for every community in the country and not adapting to the reality of differing costs for housing, food, basic needs, we are not telling a story that is accurate.”

Behind the decline

In 2011, Carrera and Flores were temporary workers, picking up assigned hotel-kitchen jobs. Combined, they made about $29,000, their W-2s show. They were paying about $700 for their apartment in central Aurora. It was run down but affordable.

Colorado was still grappling with Great Recession aftershocks. One in four Latinos and Black Coloradans (and one in 10 white Coloradans) were living in poverty.

Five years later, in 2016, as Colorado’s economy was finding its footing, voters statewide kickstarted a series of annual minimum-wage hikes. (It’s now $13.65 an hour. Denver’s is $17.29 per hour.)

Among those fighting was Services International Employees Union (SEIU) member Eva Martinez, who has been a janitor at Denver’s Republic Plaza for 29 years.

Her income supplemented her husband Jose’s, an auto detailer, and their growing family of five girls.

Between them, the couple increased their income by more than $20,000 over the last decade. Eva Martinez said she’s now making more than $18 an hour.

“I feel like our lives changed a lot,” she said in Spanish. “I feel like we have a lot more security. I feel like I was lucky that I was able to get a job that was a union job. I feel like that played a huge role in us being able to feel secure.”

The minimum-wage increase was a big boost to the lowest-wage workers, a disproportionate percentage of whom are Black and Latino. The scheduled increases also succeeded in upping minimum wages at a faster rate than the state’s median wages, said Chris Stiffler, senior economist for the “equity-focused” Colorado Fiscal Institute. Within four years, his research found, Colorado had the fifth-highest minimum wage in the country.

As the economy moved into the full flush of its long, slow economic expansion, unemployment hit record lows. Carrera and Flores started new jobs, working at 3 Margaritas, a Mexican restaurant. Their paychecks grew.

That median household income rose and official poverty levels, which are based on pre-tax wages, fell over the last decade is not surprising, Stiffler said.

“Every time you see a rocking economy, you see the poverty rate drop and a boost to wages on the lower end of the spectrum,” he said.

And Colorado was rocking. Between 2011 and 2021, Colorado had the fifth-highest growth in the U.S. in real gross domestic product. The state also had the fifth-highest gain in the nation in per capita income, growing nearly 68% over that time, according to the Bureau of Economic Analysis. Median household income over the decade outstripped inflation.

Still, other factors, direct and indirect, influenced not only how much people were earning over the decade, but also their ability to participate in the labor force in the first place, the COLab/Denver Post analysis of Census and state data found.

Among them:

- Women in Colorado have been waiting longer to have children and having fewer children overall. In 2020, only seven states had lower fertility rates.

- The percentage of births to teens plummeted, with a 66% drop for Hispanic teens between 2010 and 2020 and a 56% drop for Black teens in part due to the state’s long-acting reversible contraceptives program.

- The share of Black and Latino single-parent families, who are most vulnerable to poverty, fell slightly over the decade.

State demographer Elizabeth Garner also points to pandemic-era aid, including expanded child tax credits, as a buffer for the worst impacts of a public health and related economic crisis that disproportionately affected Black and Latino Coloradans. And larger demographic forces may be at play, she added, including the relative youth of a growing Latino population entering the labor force as older white residents leave it.

Colorado has also seen an increase in the percentage of households that are “doubling up” — living with related family members, including grown children and grandparents — boosting household incomes. In 2019, more than a quarter of Colorado kids were living in doubled-up households, according to a report by Colorado State University’s Colorado Futures Center.

Overall, the decade was good to Valerie Harris and her husband, Forris, a Black couple living in Aurora.

“We’re definitely in a better position today than we were 10 years ago,” she said.

In 2011, they were making around $65,000 together and had five children at home. They had some financially tough years after that — her husband was laid off and took a lower-paying job; she had to stop working temporarily in her job as a certified nursing assistant for health reasons — but they are now in a more stable position with three kids still at home. Her husband has a better-paying job at the Veterans Administration. She is working as a certified nursing assistant, has started her own business, Silver Lining Promotions and Management, and does tax preparation on the side. They are now making almost double what they once did, she said.

“Renting this lifestyle”

The Harrises saw their household income rise because of higher-paying work, but also because Valerie Harris has worked multiple jobs for the past decade.

The Martinezes reached financial stability because Jose Martinez worked six days a week. He worked days and Eva worked nights, so they didn’t have to pay for child care. With three of their daughters and a grandson living with them, they still work alternate schedules.

“This is also very hard because we sacrifice our relationship,” Jose Martinez said.

Carerra and Flores have yet to find stability. Their income increased by about $13,500 between 2011 and 2021, according to their W-2s. But Carrera said she sometimes works 60 hours a week because she is healthier than her husband. She also sells jewelry and food to pad their income.

It’s not enough.

The Carrera-Floreses are paying $1,675 a month for their 700-sq.ft. one-bedroom. Then there are the $584 monthly car payments, car insurance, medical bills, utilities, gas and food. Both have diabetes and other health issues. They go to Metro Caring monthly for food. Some months, they cut back on Carrera’s blood-pressure medication, though insulin is non-negotiable. And some months, they turn to the credit card. Their boss, friends and even customers sometimes help them out.

What separates Carrera, Flores, the Harrises and the Martinezes are housing costs. The Martinezes paid off their home in 2018. Flores and Carrera are paying more than double their rent in 2011, almost half their income.

The Harrises lost their home to foreclosure in the Great Recession and now pay nearly $2,400 in rent for a small house.

The couple is again working toward homeownership, a primary driver of generational wealth. According to 2021 five-year American Community Survey data, about four in 10 Black Coloradans were homeowners. (In comparison, more than 70% of white Coloradans were homeowners and 54% of Latinos.)

Her family may be doing better, Valerie Harris said, but Black Coloradans as a whole are not.

“We don’t own more homes. We don’t own more businesses. We just have more jobs. That’s not better.”

She said it feels as though Black Coloradans are “renting this lifestyle” with less ownership, and therefore, “no control over our future or our destiny.”

The fragility of economic stability became evident during the pandemic. Harris, immunocompromised, had to leave her job, so they relied on unemployment and her husband’s income. The restaurant that employed Carrera and Flores closed for a month before switching to take-out. The couple took a payday loan, got a two-month grace period on their car payments and fell behind on their electric bill.

To get a better handle on how people are doing, the Colorado Center on Law and Policy uses the University of Washington School of Social Work‘s Center for Women’s Welfare’s Self-Sufficiency Standard. Calibrated for each of the state’s 64 counties and for various family sizes and types, it takes into account the cost of housing, child care, food, health care, transportation, taxes and tax credits.

The 2022 report calculates that one adult in Arapahoe County needed to earn $38,089 to cover basic needs slightly less than what Flores and Carrera earned combined.

In Denver, a single adult with one preschooler and one child in school needed to earn more than $40 an hour full-time to meet basic needs. In Summit County, served by Voces Unidas, that same family had to earn $103,225 a year, or 448% of the federal poverty guidelines. The authors of the Self Sufficiency Standard, who refer to the poverty threshold as a better measure of “deprivation,” emphasize that their own measure includes no frills ??” no movie nights, no dinner out.

The fact that Black and Latino poverty rates have remained significantly higher than white speaks to “a long history of people of color being deprived of economic opportunity that was given to white people,” said Sarah Hughes, former research director for the Colorado Children’s Campaign.

The poverty rates, she added, are a reflection of interconnected policies and programs that have deprived people of color the same opportunities to build wealth, from redlining to higher-interest loans to inadequate school funding and lack of access to quality health care.

“Oftentimes, when people look at disparities, they often jump to individual-level explanations rather than systemic explanations when we know systemic issues are really at the root,” she said.

Closing the gaps

The bottom line, the 2022 Self-Sufficiency Standard report says, is that two ways exist to get people to self-sufficiency: lower costs or higher incomes.

Closing the equity gaps needs to be at the center of both, Nita Gonzales, a longtime community leader in Denver, said.

“Society has to know that it will not tolerate inequity as the norm,” she said. “It will not tolerate houseless relatives as the norm. It will not tolerate children that go to bed hungry as the norm. It will not tolerate people who do not have a health care home as the norm. Society has to say it’s unacceptable.”

Scott Wasserman, president of the progressive Bell Policy Center, said that the decline in poverty rates is “super encouraging when we think about raising the floor. … Where we’re stumbling is that next step.”

The focus needs to be on structural barriers to equity like housing equity and its role in creating intergenerational wealth, he said.

Affordable housing is dominating the current legislative session as well as the Denver City Council and mayoral races. Among the suggested solutions: land-use reforms, rent control, giving cities and counties dibs on apartment buildings for sale to make rents affordable.

Advocates and experts also point to expanded access to no or low-cost early childhood education as a solution that not only benefits children but parents and the economy as a whole. Colorado ranks eighth in the country for most expensive child care, with an average annual cost of $15,325, according to the Economic Policy Institute.

“We … know that when you help the child, then the parent has the ability to go to school, to go to work and to be much more productive than they have ever been,” said Elsa Holguín, president and CEO of the Denver Preschool program.

The legislature last year invested millions in the childcare industry, and free universal preschool, pushed by Gov. Jared Polis, is set to begin in fall 2023.

But advocates say there’s much more to be done, and lawmakers are looking to expand state income tax relief for families with children.

Federal safety net programs are also critical, advocates for families said. Colorado’s Democratic Sens. Michael Bennet and John Hickenlooper have argued that the expanded child tax credit, a pandemic safety net, should have been made permanent.

The tax credit “lifted 2.9 million children out of poverty” during the pandemic, U.S. Census Bureau researchers found in a 2022 analysis of its impact. A Child Trends analysis, using the same data, found the federal safety net — earned income tax credits, food stamps, Social Security, cash public assistance, housing subsidies and other programs — has played an increasingly larger role in the “astounding decline” of child poverty since 1993.

Without assisting families with child care costs, housing and health care, Wasserman said he doesn’t believe all Coloradans’ economic prosperity can improve.

Carrera and Flores said they dream of eventually being able to own a three-bedroom home with a backyard, where they can cook the foods they love and sell some of it to make money.

“We are old,” Carrera said. But what they don’t have in time, she said, they have in faith that the ability to “achieve our dreams” is still within reach.

Burt Hubbard and Rossana Longo contributed to this report.